Did an MCA Lender File a UCC Lien and Freeze Your Accounts? Here’s What to Do

- Shield Merchant

- Dec 30, 2025

- 4 min read

If you’re reading this, there’s a strong chance one of three things has already happened:

An MCA lender filed a UCC lien you didn’t fully understand at the time

Your bank account was suddenly frozen or restricted

Your merchant processing was delayed, held, or shut down with little explanation

For many business owners, these events feel abrupt and unfair—especially when the business is still generating revenue. But this situation is more common than most lenders ever explain upfront.

The good news is this:

a UCC lien and frozen accounts do not automatically mean your business is over. What matters most is what you do next.

How MCA Lenders File UCC Liens in the First Place

When you signed your merchant cash advance agreement, it likely included authorization for the lender to file a UCC-1 financing statement. This filing gives the lender a public claim against your business assets as collateral for the advance.

Most MCA UCC liens are intentionally broad. Instead of covering a specific piece of equipment or inventory, they often reference all business assets, receivables, or proceeds. This language gives the lender leverage—not immediate control, but the ability to escalate quickly if payments are disrupted.

Many business owners don’t realize a lien was filed until it shows up during a crisis.

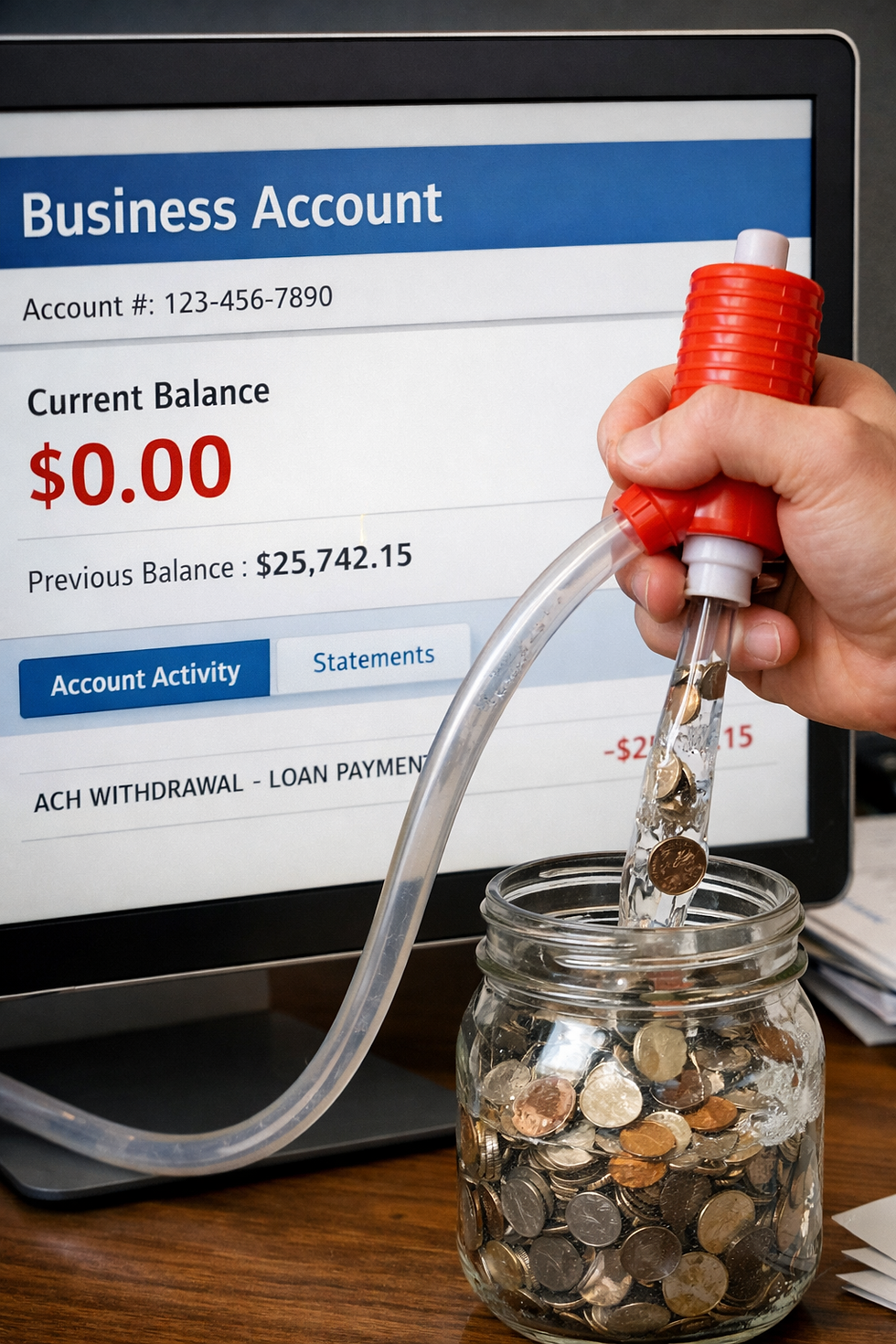

How a UCC Lien Turns Into a Bank Account Freeze

A UCC lien by itself doesn’t freeze your bank account. The freeze usually happens after a trigger event.

Common triggers include:

A failed or delayed daily ACH payment

Low balances caused by payroll, rent, or vendor payments

MCA lenders declaring a technical default based on timing—not refusal

Once default language is triggered, MCA lenders may send notices to your bank asserting rights tied to the UCC lien. Banks are extremely risk-averse in these situations. Rather than sorting out liability, many choose the safest option: freeze the account first.

From the bank’s perspective, this isn’t punishment—it’s protection. From the business owner’s perspective, it’s sudden and devastating.

Why Your Merchant Processing Gets Frozen Too

Once a bank account is restricted, payment processors often follow, or vise versa.

Processors monitor:

Bank account stability

Legal risk signals

UCC filings tied to MCA lenders

Enforcement activity or freezes

When processors see that a third party may have legal access to your funds, whether it's through their own monitoring efforts or the lender reached our directly, they worry about priority and fund diversion. Their response is often to delay settlements, hold funds, place reserves, or shut down the account entirely.

This can happen even if:

Sales are strong

Chargebacks are low

Customers are still paying

The issue isn’t performance—it’s risk exposure.

Why Stripe, Square, Quickbooks, and Similar Platforms Freeze Fast

If you’re using any of these pay-facilitators, freezes tend to happen faster and with fewer options to appeal.

These platforms rely heavily on automated risk systems. When their systems detect UCC liens, legal enforcement signals, or unstable cash flow patterns tied to MCAs, funds are often frozen immediately to limit exposure.

Once frozen, funds may be held for months. Human review is limited. Explanations are minimal.

If Your Accounts Are Frozen, Here’s What Not to Do

When panic sets in, many business owners make moves that worsen the situation:

Opening random new bank accounts without a plan that will also be jeopardized

Stacking another MCA to “catch up”

Ignoring lender notices

Switching to a new processor only to later discover they will also hold your funds.

These reactions can escalate enforcement, trigger additional freezes, or eliminate remaining options.

What To Do Instead: The Right Next Steps

If an MCA lender filed a UCC lien and your accounts are frozen—or close to it—the priority is stabilization, not confrontation.

The most effective steps focus on:

Restoring or preserving the ability to accept payments

Reducing automatic lender access to operating funds

Separating processing risk from enforcement activity

Regaining control over cash flow timing

This is a structural problem, not a sales problem. Making more money alone rarely fixes it—and often makes it worse.

Why Timing Matters More Than Anything

Businesses that act before enforcement escalates have significantly more options. Once funds are fully locked and processors terminate accounts, recovery becomes slower and more limited.

If MCA withdrawals are tightening control, or a UCC lien has already been filed, waiting rarely improves the outcome.

Early action can mean the difference between:

Continuing operations vs. complete shutdown

Temporary disruption vs. long-term damage

How Shield Merchant Helps in These Situations

Shield Merchant works with businesses dealing specifically with:

MCA pressure

UCC lien exposure

Frozen or terminated merchant accounts

Cash flow compression caused by daily withdrawals

The goal is not to avoid obligations or ignore agreements. The goal is to protect the business’s ability to operate while restoring financial control.

When cash flow is stabilized and processing is secured, business owners can finally address obligations strategically instead of reacting daily.

Final Thought

If an MCA lender filed a UCC lien and your accounts are frozen, you’re not alone—and you’re not out of options.

This situation isn’t a reflection of failure. It’s the result of a system designed to prioritize lender access over business stability.

What matters now is acting deliberately, not emotionally, and addressing the structure before more damage is done.

If your accounts are frozen—or you see the warning signs—the next move matters more than the last one.

Comments