Can a UCC Lien Stop You From Accepting Credit Cards?

- Shield Merchant

- Dec 15, 2025

- 2 min read

Short answer: Yes—indirectly, and it happens more often than business owners realize.

What Is a UCC Lien?

A UCC (Uniform Commercial Code) lien gives a lender a legal claim against your business assets. MCA lenders almost always file a UCC-1 lien as collateral for the advance.

While a UCC lien doesn’t technically “ban” you from accepting credit cards, it creates a chain reaction that often results in:

Frozen merchant accounts

Withheld card settlements

Processor account shutdowns

At first glance, a UCC lien doesn’t seem like it should affect your ability to accept credit cards. After all, a UCC filing is a legal document, not a payment processor. Yet every year, thousands of business owners discover the hard way that once a UCC lien enters the picture, their ability to accept card payments becomes unstable—or disappears entirely.

The truth is that a UCC lien doesn’t directly shut off credit card processing, but it changes how processors perceive your business, and that perception is what causes the real damage.

When a lender files a UCC-1 lien, they are publicly declaring a legal claim on your business assets. Merchant cash advance lenders almost always file these liens, often with very broad language that covers “all business assets,” including receivables and cash flow. Payment processors regularly scan public records and banking behavior to assess risk. When they see an active UCC lien—especially one tied to an MCA—it raises immediate red flags.

Processors are not just concerned about whether you can pay them. They worry about priority and control. If another party has legal access to your cash flow, the processor fears that card revenue could be intercepted, frozen, or seized without warning. From the processor’s perspective, that creates exposure they don’t want.

This is why businesses with UCC liens often experience delayed deposits, sudden reserve requirements, or unexplained funding holds. In more severe cases, the processor may terminate the account entirely, citing “risk profile changes” or “financial instability.” To the business owner, it feels abrupt and unfair. To the processor, it feels preventative.

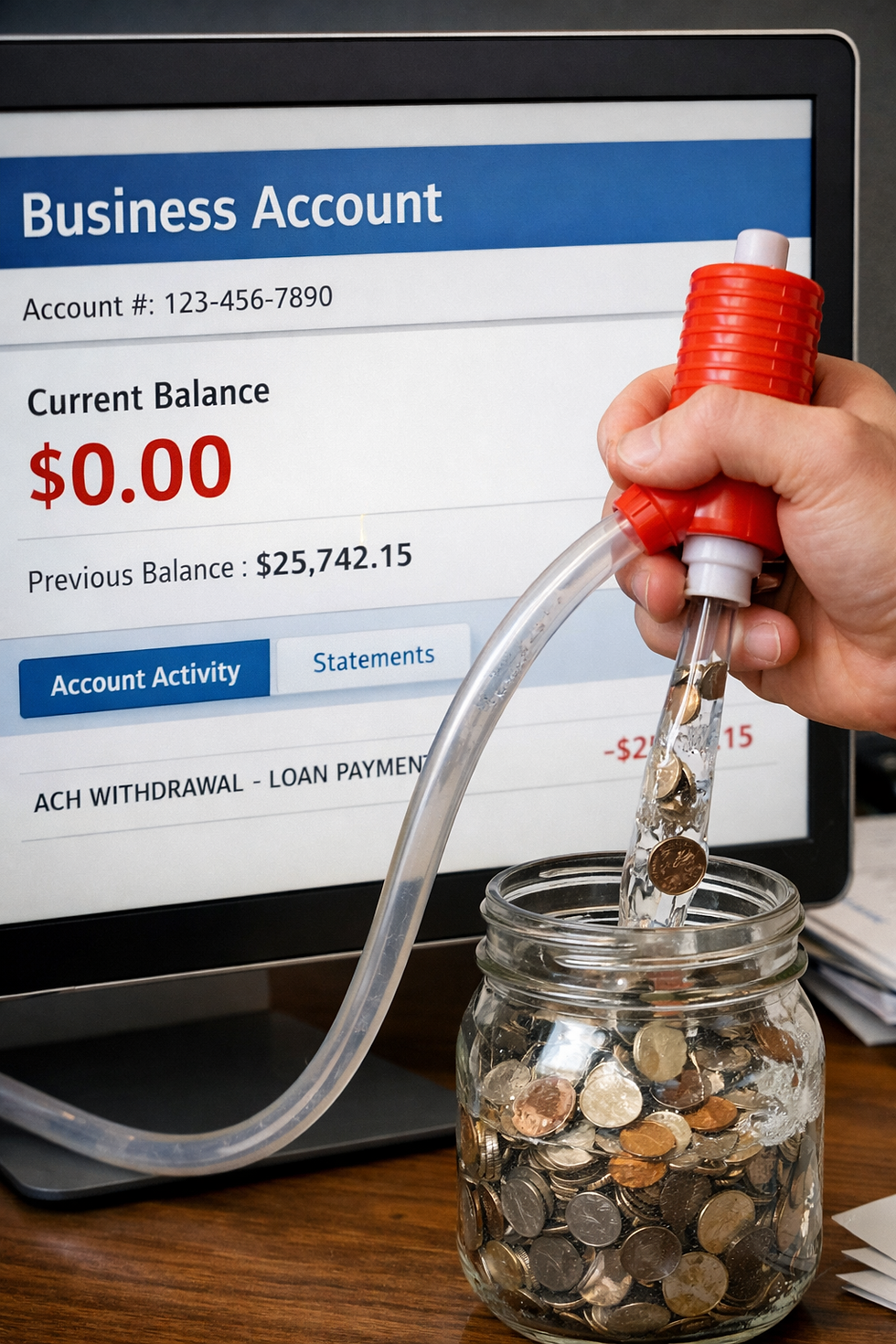

Another overlooked issue is cash flow behavior. UCC liens tied to MCAs almost always come with daily ACH withdrawals. Those daily debits can cause balance fluctuations, near-zero end-of-day balances, or occasional overdrafts. Processors monitor this activity closely. Even if your sales are strong, unstable bank behavior can trigger risk systems.

The real danger is that many business owners don’t realize the connection until after their funds are frozen. By then, payroll, rent, vendors, and inventory are all at risk.

How Shield Merchant Helps

Shield Merchant offers Protected Merchant Accounts that:

Separate processing from MCA enforcement

Reduce freeze risk

Provide continuity of card acceptance

Key takeaway: A UCC lien doesn’t stop credit cards directly—but it often causes the processor to pull the plug.

Comments